Before applying for a car title loan pre-approval, understand lender requirements, including vehicle inspections affecting loan amount and terms. Assess your financial health as your credit score impacts eligibility. Compare lenders for interest rates, repayment periods, and fees to secure favorable conditions.

Before securing a car title loan, avoid common pitfalls that could cost you dearly. This guide will help you navigate the process with confidence. First, grasp the intricacies of loan terms to make informed decisions. Next, review your credit score and history to ensure eligibility. Lastly, compare lender options to secure the best rates for your car title loan pre-approval. Understanding these steps will safeguard your financial well-being.

- Understand Loan Terms Before You Apply

- Check Your Credit Score and History

- Weigh Lender Options for the Best Rates

Understand Loan Terms Before You Apply

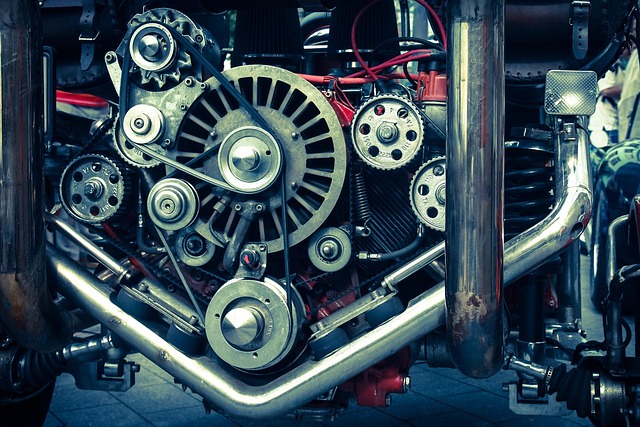

Before applying for a car title loan pre-approval, it’s crucial to familiarize yourself with the loan terms and conditions. Car title loans, secured by your vehicle, often come with specific requirements and implications that can significantly impact your financial situation. Understanding these involves knowing the process of a vehicle inspection, where lenders assess your car’s value, condition, and potential resale market worth. This step is vital as it determines the loan amount you qualify for and can affect your overall repayment terms.

Additionally, be aware that loan extensions might be an option if unexpected financial hardships arise during your repayment period. However, these extensions often come with additional fees and interest charges, so ensure you read through all paperwork carefully. Flexible payments are another perk, allowing you to tailor your repayment schedule to suit your budget. But again, different lenders may have varying policies on payment flexibility, so comparing terms from multiple lenders can help secure the best deal for your car title loan pre-approval.

Check Your Credit Score and History

Before applying for a car title loan pre-approval, it’s vital to understand your financial standing. Your credit score and history play a significant role in determining your eligibility and the terms of the loan. A low credit score can result in higher interest rates and less favorable conditions.

Regularly checking your credit report allows you to identify errors or discrepancies that might negatively impact your rating. Reviewing it also helps you understand your financial health, enabling you to make informed decisions regarding a car title loan as a potential financial solution when facing unexpected expenses or emergency funds requirements, especially if direct deposit is preferred for swift access to the approved funds.

Weigh Lender Options for the Best Rates

When seeking a car title loan pre-approval, one key step is to weigh different lender options. Not all lenders offer the same rates and terms, so it’s essential to compare their proposals based on interest rates, repayment periods, and any additional fees. This process will help you secure the best possible deal for your car title loan pre-approval.

Consider that a lender offering quick approval might charge higher interest rates or have less flexible terms compared to one that takes slightly longer but provides more favorable conditions. Additionally, while some lenders may specialize in title pawn services, others could be better suited for debt consolidation, allowing you to choose the option that aligns most closely with your financial goals and needs.

Before securing a car title loan, thoroughly understanding the terms and conditions is crucial. Checking your credit score and exploring different lender options to secure the best rates are essential steps in the pre-approval process. By doing so, you can avoid common pitfalls and make an informed decision when applying for a car title loan pre-approval.