Car title loan pre-approval offers quick access to cash for borrowers with less-than-perfect credit by assessing vehicle equity instead of credit scores. This process simplifies budget planning, provides flexible terms, and allows approvals within 24 hours. However, it comes with higher interest rates and the risk of losing the vehicle if repayments fail, requiring careful consideration before committing.

Looking to get a car title loan quickly? Car title loan pre-approval is the first step towards securing fast cash using your vehicle’s equity. This process allows lenders to assess your application and give you an upfront approval estimate, making the borrowing experience smoother. In this article, we’ll guide you through the pre-approval process, highlight the top fast lenders offering instant pre-approvals, and outline key benefits and considerations before borrowing.

- Understanding Car Title Loan Pre-Approval Process

- Top Fast Lenders for Instant Pre-Approvals

- Benefits and Considerations Before Borrowing

Understanding Car Title Loan Pre-Approval Process

Getting pre-approved for a car title loan is a straightforward process designed to help borrowers understand their borrowing power and budget accordingly. It involves providing essential information about your vehicle, its make, model, year, and overall condition, which is then evaluated by lenders. This initial step bypasses the need for extensive credit checks, making it accessible to individuals with less-than-perfect credit histories. Lenders will assess the value of your car to determine a loan amount, ensuring it aligns with your financial goals.

Pre-approval offers several benefits. It allows borrowers to explore various repayment options and flexible payment plans tailored to their needs. This transparency empowers them to make informed decisions about their loans, including understanding potential interest rates and terms. Additionally, pre-approved applicants often have a smoother process when converting pre-approval into an actual loan, saving time and effort in the long run, especially when facing urgent financial needs.

Top Fast Lenders for Instant Pre-Approvals

When you need cash quickly, a car title loan pre-approval can be a lifesaver. Several lenders stand out for their lightning-fast approval process, making them top choices for those in need. These lenders understand that urgency often drives borrowers to consider alternative financing options and have streamlined their application procedures accordingly.

Among the fastest lenders offering car title loan pre-approvals are reputable institutions known for their efficiency and customer-centric approach. They prioritize providing instant access to funds, ensuring borrowers can make informed decisions without delay. These lenders cater to a wide range of borrowers, including those with less-than-perfect credit, by considering the value of their vehicles rather than strict credit checks. With flexible loan terms tailored to individual needs, they offer a practical solution for short-term financial requirements.

Benefits and Considerations Before Borrowing

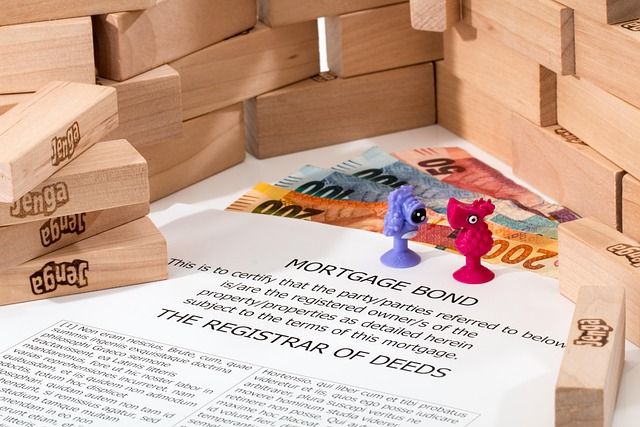

Car title loan pre-approval offers several advantages for borrowers seeking a fast and convenient financing option. One of the key benefits is speed; with pre-approval, you can have access to funds in as little as 24 hours, making it an attractive choice for those needing cash urgently. This process streamlines the borrowing experience by evaluating your vehicle’s equity rather than focusing solely on traditional credit scores, which opens doors for individuals with less-than-perfect credit histories.

Before considering a car title loan, there are some crucial aspects to think about. While quick approval is a plus, these loans often come with higher interest rates compared to traditional bank loans. Additionally, borrowers should be prepared to potentially lose their vehicle if they fail to repay the loan as agreed. It’s essential to weigh these factors and ensure that debt consolidation or a cash advance from other sources might be more suitable alternatives depending on individual financial situations.

When seeking a car title loan, getting pre-approved is a smart step that can save you time and money. The fastest lenders in this space offer instant pre-approvals, streamlining the process for borrowers. By understanding the pre-approval process, comparing top lenders, and being aware of benefits and considerations, you can make an informed decision when borrowing against your vehicle’s title. Remember, a car title loan pre-approval is a crucial first step towards accessing the financial support you need.