Car title loan pre-approval streamlines financial access for Houston and San Antonio residents lacking conventional banking records. Lenders assess vehicle equity, income stability through alternative proof (pay stubs, tax forms), and personal details to offer personalized rates and terms. This method provides quick funds but comes with higher interest rates, shorter repayment periods, and lower limits compared to traditional loans, demanding prudent financial management for timely loan payoff.

“Thinking about a car title loan but wary of traditional bank statement requirements? Discover how you can achieve pre-approval without these documents. This guide delves into the simplified process, exploring alternative proof of income methods and the benefits they offer.

We’ll break down the advantages and potential drawbacks of car title loan pre-approval without bank statements, empowering you with knowledge to make an informed decision in today’s fast-paced financial landscape.”

- Understanding Car Title Loan Pre-Approval Process

- Alternative Documentation for Income Proof

- Benefits and Considerations of Car Title Loans Without Bank Statements

Understanding Car Title Loan Pre-Approval Process

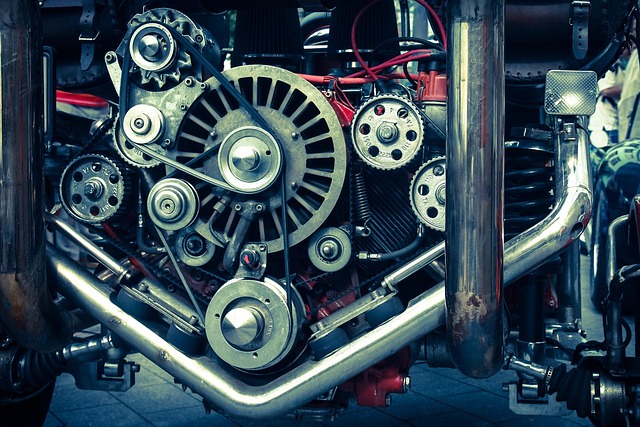

When considering a car title loan, understanding the pre-approval process is crucial. Car title loan pre-approval is an initial step that involves assessing your vehicle’s value and verifying your financial information. This process provides a clear picture of how much money you can borrow based on the equity in your vehicle without requiring traditional bank statements. Lenders will evaluate factors such as your vehicle’s make, model, year, overall condition, and mileage to determine its worth. Additionally, they’ll look at your income, employment status, and other relevant financial details to gauge your ability to repay the loan.

In Houston, where title loans are prevalent, the car title loan process streamlines the borrowing experience. Pre-approval allows lenders to offer personalized rates and terms tailored to your unique situation. This financial assistance can be especially beneficial for those with limited or no credit history, as it provides an alternative lending option. The pre-approval step ensures a smoother transaction, enabling you to make informed decisions about securing a loan using your vehicle’s equity.

Alternative Documentation for Income Proof

When applying for a car title loan pre-approval without traditional bank statements, potential borrowers might wonder about alternative income proof options. Lenders in San Antonio loans often accept various documents to verify your financial stability and ability to repay the loan. Besides bank statements, these can include pay stubs, W-2 forms, 1099 tax forms, or even employment contracts with details of your salary and tenure at the current job. This flexibility is one of the perks of using vehicle collateral for loans.

The process streamlines borrowing by allowing individuals to access funds quickly without extensive paperwork. With a car title loan pre-approval, borrowers can navigate the financial landscape with greater ease, ensuring flexible payments tailored to their income and repayment preferences. This alternative approach to income verification is particularly beneficial for those who don’t have traditional bank statements but still require immediate financial support.

Benefits and Considerations of Car Title Loans Without Bank Statements

Car title loan pre-approval without bank statements offers a unique opportunity for individuals seeking quick financial support. This alternative lending method is particularly beneficial for those who may not have traditional banking records or wish to avoid the cumbersome process of providing detailed financial documentation. By leveraging their vehicle’s equity, borrowers can access substantial funds, providing a much-needed financial safety net during unforeseen circumstances.

However, it’s essential to consider potential drawbacks. Lenders will typically assess the value of your vehicle and its current condition to determine loan amounts, which may result in lower borrowing limits compared to traditional loans. Additionally, these loans often come with higher interest rates and shorter repayment periods, emphasizing the need for careful planning to ensure timely loan payoff. Understanding these factors is crucial when deciding whether a car title loan pre-approval is the right choice for your financial needs.

Car title loan pre-approval without bank statements is a viable option for borrowers who need quick access to cash. By accepting alternative documentation, lenders streamline the process, offering a convenient and efficient solution. This type of pre-approval can be particularly beneficial for those in urgent financial situations, as it provides an alternative to traditional banking requirements. However, borrowers should carefully consider the benefits and potential drawbacks, ensuring that this short-term solution aligns with their long-term financial goals.